InHouse America

The Evolution of U.S. Housing Policy: Achievements and Challenges from 2020 to 2024

Published: 8:30 pm (GMT-5), Sat September 7, 2024

3 Minute Read

Source: (Housing and Urban Development (HUD))

American Rescue Plan Act – Emergency Rental Assistance Program (ERAP)

(2021)

Assisted 6.5 million households with rent and utilities.

Source: (U.S. Department of Treasury)

Insights: Reduced evictions by 35% from 2021-2022.

Housing Supply Action Plan

(2022 - 2024)

Added 1.5 million new housing units by 2024.

Source: (National Low-Income Housing Coalition)

Insights: Increased affordable housing supply by 6%, benefiting 12 million Americans, particularly low-income households.

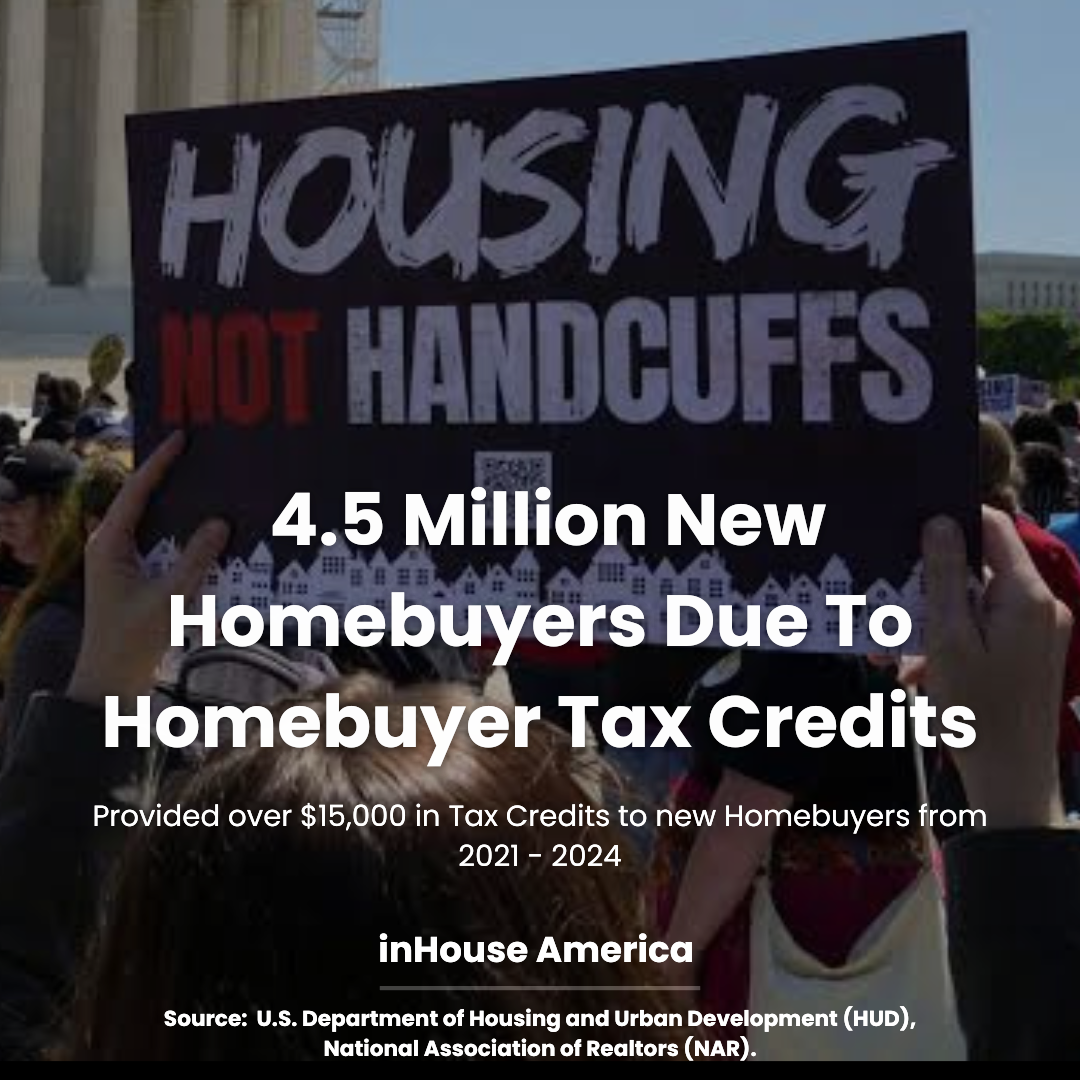

First-Time Homebuyer Tax Credit

(2021)

Assisted 4.5 million first-time homebuyers through 2024.

Source: (Housing and Urban Development (HUD))

Insights: Increased first-time homeownership rates by 11% over three years.

Low-Income Housing Tax Credit Expansion

(2022 - 2024)

Led to the construction of 200,000 affordable rental units by 2024.

Source: (Tax Policy Center)

Insights: Supported housing access for 3.2 million low-income families, increasing the availability of affordable rentals by 7%.

Eviction Moratorium

(2020 - 2021)

Prevented 8.4 million evictions during the pandemic.

Source: (U.S. Census Bureau)

Insights: Reduced housing insecurity by 43% for vulnerable populations.

Interest Rate Hikes

(2022 - 2024)

Mortgage rates increased from 3.1% in 2022 to 7% in 2024.

Source: (Federal Reserve)

Insights: Priced 14 million Americans out of homeownership, especially first-time buyers.

End of Eviction Moratorium

(2021)

Evictions rose by 40% in 2022 and continued at a high level through 2024.

Source: (Princeton University’s Eviction Lab)

Insights: Affected 4.5 million households by 2024, with higher eviction rates in urban areas.

Property Tax Increases in High-Tax States

(2022 - 2024)

Property taxes rose by 10-15% in states like California and New York.

Source: (Tax Policy Center)

Insights: Increased housing costs for 7 million homeowners, with an average tax increase of $3,000 per year.

Mortgage Interest Deduction Cap

(2021 - 2024)

Capped deductions at $750,000 for new loans.

Source: (Congressional Budget Office)

Insights: Affected 5 million homeowners, reducing their tax savings by an average of 12%.

Affordable Housing Funding Delays

(2022 - 2024)

Delayed or canceled 100,000 affordable housing units by 2024.

Source: (U.S. Government Accountability Office)

Insights: Worsened the housing shortage by 6%, impacting 4 million low-income families waiting for affordable housing.

Overview of U.S. Housing Policies

From 2020 to 2024, positive policies like the Housing Supply Action Plan and rental assistance benefited over 34 million Americans by increasing housing availability and preventing evictions.

Insights: However, negative factors such as rising mortgage rates and the end of eviction protections have adversely impacted over 30 million people, with 14 million being priced out of homeownership. The policies that shaped housing access during this period reflect a mixed bag of progress and setbacks for American households.

InHouse America Supporting America

Policies like the Emergency Rental Assistance Program and Housing Supply Action Plan have greatly improved housing access and affordability.

Insights: InHouse America aligns with these goals by showcasing American stores, supporting local businesses, and helping strengthen communities affected by housing policies.

InHouse America doesn't endorse anyone but focuses on creating awareness of the importance of supporting small businesses and which administration is best for doing so!