InHouse America

Home Prices Skyrocket by 120%, Impacting 81 Million American Homeowners

Published: 13:02 pm (GMT-5), Thur August 29, 2024

2 Minute Read

Source: (U.S. Census Bureau, National Association of Realtors (NAR))

Home Price Growth

Median home prices increased from $188,900 in 2014 to $416,100 in 2024 (+120%), affecting around 81 million homeowners.

Source: (National Association of Realtors (NAR), U.S. Census Bureau)

Insights: California saw even higher prices, with median values over $800,000.

Housing Supply

New housing increased from 1.1 million in 2014 to 1.3 million in 2024.

Source: (U.S. Census Bureau)

Insights: Affecting about 32 million Americans by creating new housing units, particularly in Texas.

Mortgage Rates

Mortgage rates dropped from an average of 4.17% in 2014 to 3.75% in 2024.

Source: (Freddie Mac)

Insights: Benefiting around 48 million mortgage holders.

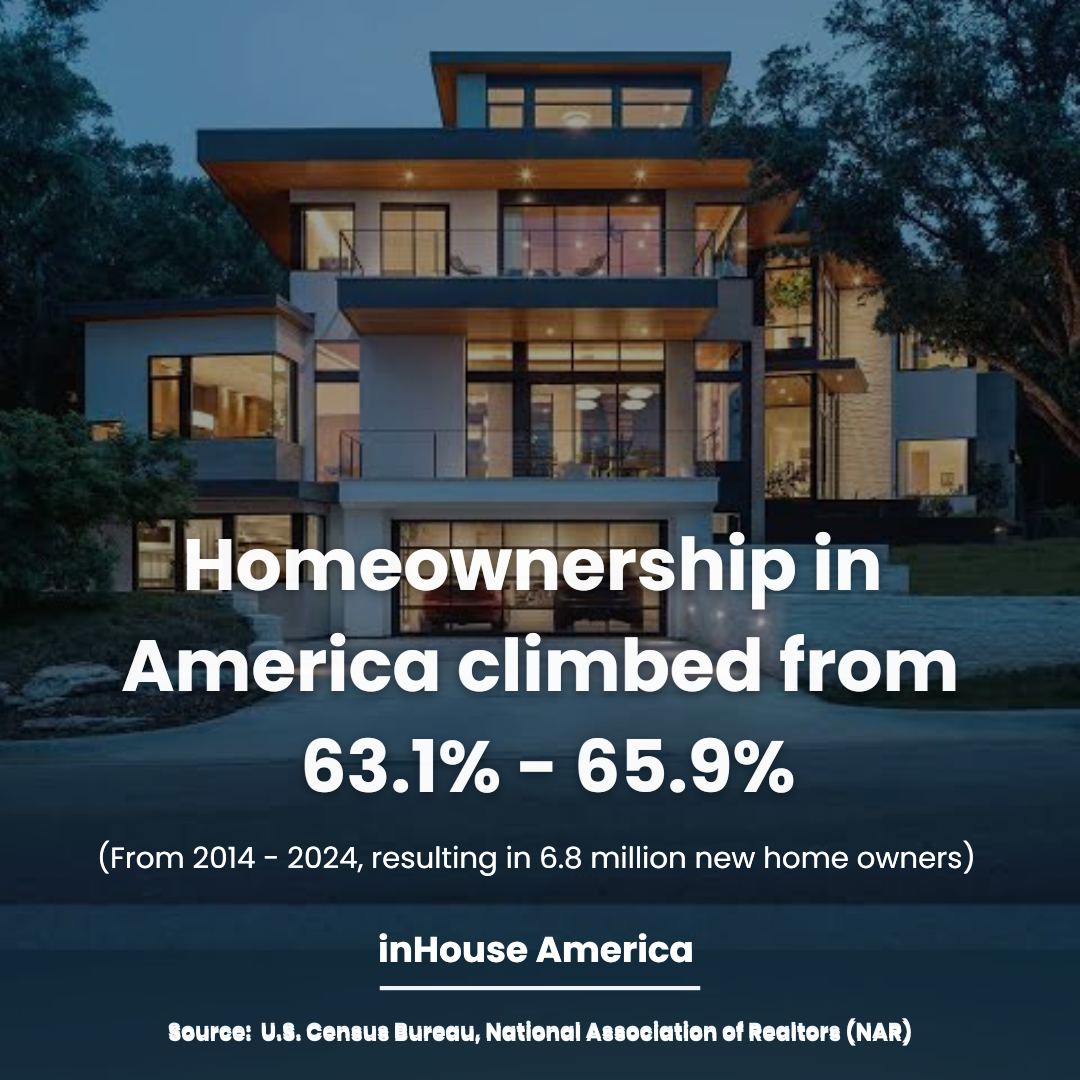

Homeownership Rates

The homeownership rate increased from 63.1% in 2014 to 65.9% in 2024.

Source: (U.S. Census Bureau, National Association of Realtors (NAR))

Insights: Adding approximately 6.8 million new homeowners, with Florida seeing a 3.2% increase.

Affordability Decline

The median home price-to-income ratio rose from 3.6 in 2014 to 5.2 in 2024.

Source: (National Association of Realtors (NAR))

Insights: Impacting about 52 million potential homebuyers, especially first-time buyers.

Rental Costs

Average rent for a two-bedroom apartment increased from $1,150 in 2014 to $1,820 in 2024 (+58%).

Source: (U.S. Department of Housing and Urban Development (HUD))

Insights: Affecting roughly 44 million renters, particularly in urban areas like New York and San Francisco.

Housing Supply Shortage

The available housing inventory dropped from 2.2 million in 2014 to 1.1 million in 2024.

Source: (National Association of Realtors (NAR), U.S. Census Bureau)

Insights: Significantly impacting 128 million Americans in need of housing, especially in high-demand areas like Austin, Texas.

Conclusion: Impact of Housing Access (2014-2024)

From 2014 to 2024, 81 million homeowners saw property values double to $416,100. Mortgage rates dropped to 3.75%, benefiting 48 million mortgage holders.

Source: (National Association of Realtors (NAR), U.S. Census Bureau, Freddie Mac, U.S. Department of Housing and Urban Development (HUD))

Insights: However, affordability fell, affecting 52 million potential buyers. Rental costs rose by 58%, impacting 44 million renters, while the housing inventory shortage affected 128 million Americans, leading to challenges in accessing housing, especially in high-demand areas.

inHouse America Contribution

By promoting Small American Businesses, InHouse America helps to strengthen local economies, providing financial stability that can mitigate the impacts of rising living costs and housing shortages.

Source: (inHouseamerica.com)

Insights: With 128 million people facing a housing inventory shortage, platforms like inHouse America will increase engagement around small businesses which will help many small businesses and their employees gain the opportunity to afford to live the American Dream.

inHouse America doesn't endorse anyone but focuses on creating awareness of the importance of supporting small businesses and which administration is best for doing so!